Crystal Cay Condos – Laguna Niguel 92677 Seller Market Guide

Crystal Cay Condos – Laguna Niguel 92677 Seller Market Guide (As of August 13, 2025)

Crystal Cay is one of Laguna Niguel’s most active and sought-after condo communities. Located minutes from the beach and directly connected to scenic trails, it offers affordability, amenities, and consistent buyer demand. If you’re thinking of selling, here’s a data-backed, visually organized look at the market right now.

📊 Market Snapshot

-

Median Sale Price (12 Months): $592,500

-

Median Price per Sq.Ft. (12 Months): $599

-

Median Days on Market: 66 (list to pending)

-

Sale-to-List Price Ratio: 98%

-

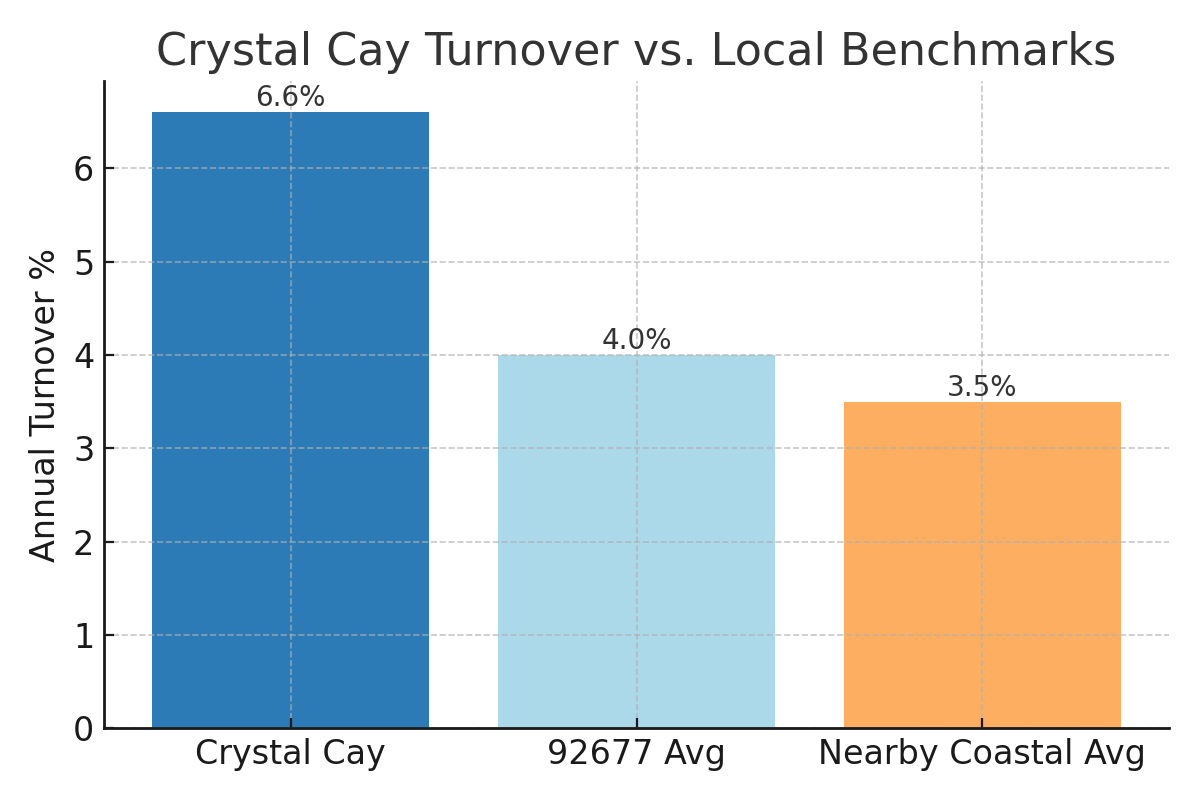

Annual Turnover: 6.6% (20 sales / 303 units)

-

Current Inventory: 4 active listings (~6.0 months supply)

-

Financing: FHA & VA historically accepted — verify current status before listing.

What This Means: A 6.6% turnover rate is high for a coastal condo complex, meaning more owners here sell each year than in most nearby communities. This signals steady buyer interest and market liquidity.

🏠 About the Community

-

Built: 1983–1984

-

Total Units: ~303

-

Floor Plans:

-

1BR: ~715–776 sq.ft. (some lofts up to ~900 sq.ft.)

-

2BR: ~873–1,171 sq.ft. (some vaulted ceilings or loft layouts)

-

-

Parking: One assigned carport per unit; guest parking scattered throughout.

-

Amenities: Two pools, two spas, landscaped greenbelts, and a small dog run.

-

HOA Dues: ~$450 + ~$117/month (two-HOA structure). Covers water, trash, exterior maintenance, and amenities.

-

Location: Off Golden Lantern, walking access to Colinas Bluff Trail; short drive to Dana Point Harbor.

-

Access: Not gated — convenient for buyers, agents, and deliveries.

👥 Who’s Buying in Crystal Cay?

First-Time FHA Buyer

Wants turnkey finishes, minimal repairs, and appreciates community amenities.

VA Buyer

Looking for a coastal foothold with pet-friendly policies, often choosing upper vaulted units with light and views.

Investor

Attracted by strong rental demand, low vacancy, and minimal restrictions.

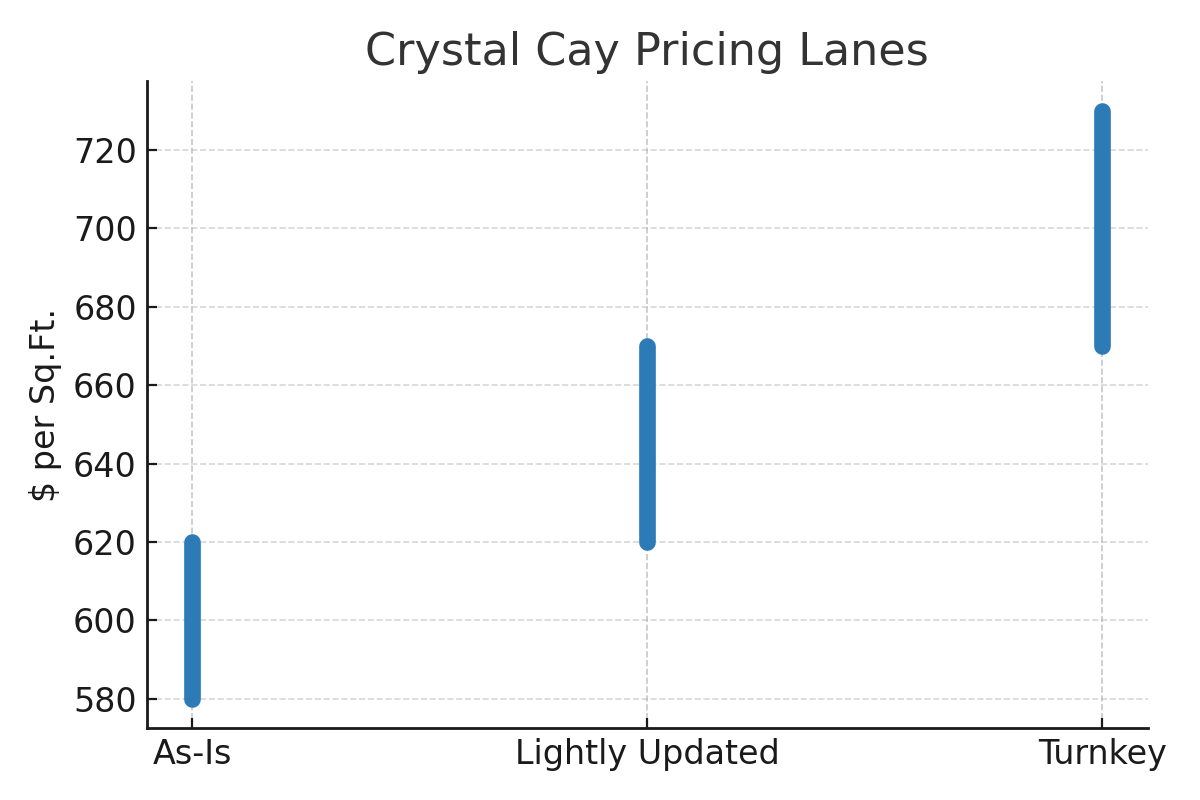

💰 Pricing Lanes for Sellers

|

Lane Type |

$/Sq.Ft. Range |

Typical DOM |

Example Sale |

|---|---|---|---|

|

As-Is / Original |

$580–$620 |

60–90 days |

51 Grenada #158 – $601/sf |

|

Lightly Updated |

$620–$670 |

30–60 days |

25 Pearl – $596/sf |

|

Turnkey / Remodeled |

$670–$730+ |

< 4 weeks |

13 Pearl – $734/sf |

Pro Tip: Upper vaulted units, greenbelt views, and end-units can add measurable premiums. Road-facing or noise-affected locations may sell slightly below lane averages.

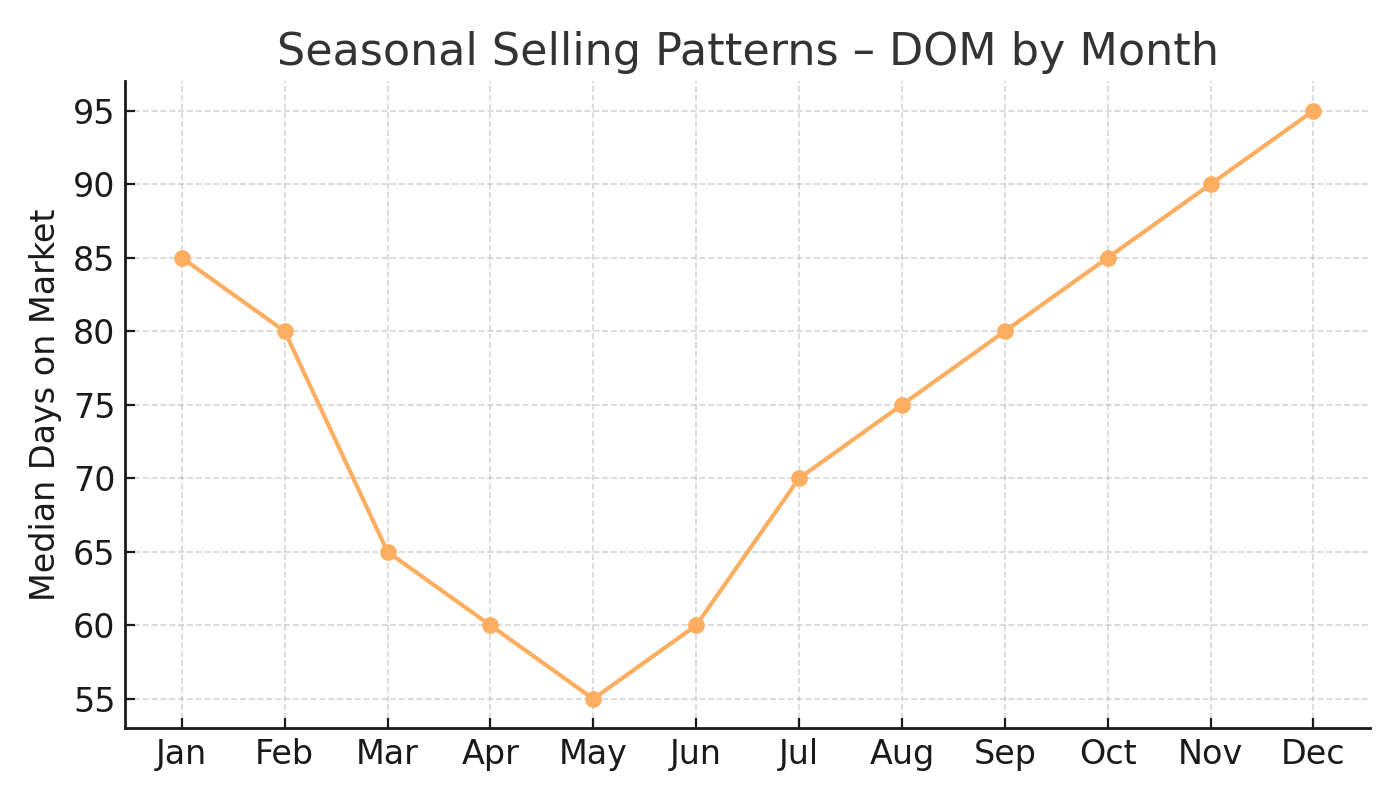

📅 Seasonal Selling Patterns

-

Spring: Peak demand and fastest sales.

-

Summer: Lower urgency, but standout listings still move.

-

Fall/Winter: Fewer buyers, less competition — turnkey homes still sell quickly if priced right.

🏷 Recent Sales (Past 12 Months)

-

119 Grenada #190 – 2BR/2BA, 1,171 sq.ft. — $680,000 ($581/sf) — Updated end-unit.

-

25 Pearl – 2BR/2BA, 981 sq.ft. — $585,000 ($596/sf) — Light updates.

-

65 Grenada #164 – 2BR+Loft/2BA, 1,096 sq.ft. — $650,000 ($593/sf) — Remodeled.

-

3 Aruba #233 – 2BR/2BA, 915 sq.ft. — $629,000 ($687/sf) — Upgraded.

-

13 Pearl – 1BR/1BA, 715 sq.ft. — $525,000 ($734/sf) — Fully remodeled.

-

85 Pearl – 1BR/1BA, 873 sq.ft. — $585,000 ($670/sf) — Updated.

-

51 Grenada #158 – 2BR/2BA, 915 sq.ft. — $550,000 ($601/sf) — Mostly original.

📈 Long-Term Perspective

While Crystal Cay prices adjust with market cycles, long-term owners have seen consistent appreciation. Demand remains steady due to the community’s location, amenities, and entry-level pricing compared to nearby coastal options.

💼 Investor Snapshot

-

Typical Rents: $2,450–$2,800/mo (1BR); $2,700–$3,100/mo (2BR)

-

Estimated Gross Yield: ~6% before expenses

-

Rental Rules: No published rental cap; verify details with HOA.

🛠 3-Step Seller Strategy

Step 1 – Precision Pricing

Use only Crystal Cay comps matched to your exact plan, condition, and location.

Step 2 – High-ROI Updates

Fresh flooring, neutral paint, and modern fixtures can significantly improve first impressions.

Step 3 – Escrow Ready

Prepare HOA documents, insurance certs, and financing eligibility in advance to avoid delays.

🔑 Key Takeaways

-

Crystal Cay has one of the highest turnover rates in coastal South OC condos at 6.6%.

-

Pricing within the right lane and investing in small updates can speed up your sale and maximize value.

-

With strong year-round demand and low inventory, a well-prepped listing here stands out quickly.

Thinking of selling your Crystal Cay condo?

Get your Custom Seller Kit with a detailed price lane report, upgrade recommendations, and a 90-day action plan.

[Request Your Seller Kit →]

Categories

- All Blogs (18)

- 92677 (1)

- 92807 (1)

- anaheim hills (2)

- anaheim hills 92807 (1)

- anaheim hills condo (1)

- corona (1)

- crystal cay laguna niguel (1)

- deerfield irvine (1)

- East Lake Village Condo (1)

- eastvale (1)

- el camino real (1)

- garden grove (1)

- garden grove market update (1)

- Home Selling Advice (2)

- housing market (1)

- irvine (2)

- irvine condo (1)

- irvine market update (1)

- irvine real estate (1)

- la-vista (1)

- laguna niguel (2)

- monaco 92808 (1)

- monaco anaheim hills (1)

- narco (1)

- property tax update (1)

- riverside (1)

- Seller Market Updates (2)

- selling in irvine (1)

- Selling in Yorba Linda (1)

- tax deduction (1)

- the springs irvine (1)

- Travis Ranch Yorba Linda 92887 (1)

- viewpoint north anaheim hills (1)

- Yorba Linda Seller Tips (1)

Recent Posts

![Should I Sell My Home in Deerfield, Irvine? [August 2025 Market Breakdown for Owners]](https://cdn.lofty.com/image/fs/844768212170573/website/134117/cmsbuild/w600_202587_99854be06c7640ce-png.webp)

OC vs IE Home Strategist | License ID: 02210139

+1(714) 266-3044 | abidur@ochomepartner.com